Corporate myths [urban legends] run rampant in organizations of all sizes. Unchallenged with market intelligence, these myths mask opportunities for revenue growth as well as lead to poor decisions with serious consequences. Typically, corporate myths are based on half-truths and limited inputs. Most companies don’t go too far beyond their sales reps, prospects and customers when seeking win/loss information, giving them fragmentary insights. Compounding the problem, these limited sources often provide only partial facts. Sales professionals who lose a bid may hesitate to bring up all the contributing factors as they could negatively impact a performance review. Lost prospects often don’t provide the full story either, frequently quoting price differences—an easy, impersonal and non-confrontational excuse—as the reason for going elsewhere. While price may indeed be an issue, it’s likely that the whole truth is more complicated. However, the price message is what gets reported up the chain, launching the myth that prices are too high. Sound familiar?

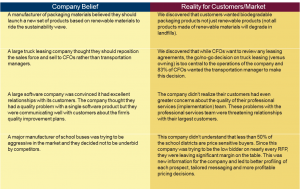

While price is one of the most prevalent myths arising from half-truths and too-few voices, it is certainly not the only one. A manufacturer of packing materials believed it needed to ride the sustainability wave by launching a new set of products using renewable materials. A large truck leasing company believed it should reposition its sales force to sell to CFOs rather than transportation managers. Both these beliefs were rooted in internal hypotheses without validation from customers or other market sources. The reality was quite different.

When companies take action on these kinds of myths, they wind up devoting scarce resources to a problem that doesn’t exist while the real problems go unsolved. Misalignment of internal perceptions and external realities further lead to lost opportunities and diminished competitive advantage.

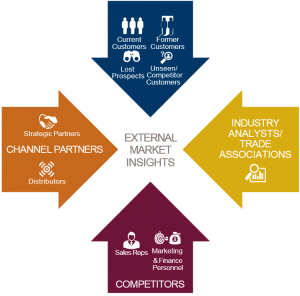

To dispel corporate myths and gain a true understanding of why you win and lose, companies need to get out into the market and talk with a range of stakeholders who all have different perspectives – current and lost customers, channel partners, competitors and more. In all, we recommend organizations gather perspective from nine different sources, an approach called The Nine Voices of the Market®:

Beyond the widely known “voice of the customer,” discussions with the right people in the other eight groups create a powerful understanding of how the company is viewed in the market. A competitor’s sales reps, for example, are an overlooked but important source of information about competitor pricing, weaknesses, strategy and more. Think they won’t give you that information? You’d be surprised. We are constantly amazed at what our clients’ competitors will tell us if we just ask.

The key to all these conversations is to dig deep for the truth and go beyond initial answers that may reflect only partial truths. Ask engaging, thought-provoking questions that go beyond specific transactions or narrow aspects of the relationship. Doing so will reveal surprising truths. For instance, when the aforementioned manufacturer of packaging materials used the Nine Voices approach, leaders discovered their customers actually wanted biodegradable packaging products. Not all products made of renewable materials will biodegrade. This revelation saved the company immeasurable time and money while enabling them to pursue a product development strategy consistent with customer desires. Similarly, the truck leasing company learned through its Nine Voices effort that more than 8 in 10 CFOs wanted the transportation manager to make the go/no-go decision on truck leasing. Had the company taken action on its belief that the sales force needed to start selling to the CFO, it would have re-tooled its sales force and targeting strategy erroneously.

When seeking input from the Nine Voices, we urge companies to have live conversations, either over the phone or in person. Opinion surveys, a common method of gathering insight, rarely provide the facts needed to identify growth opportunities as they don’t allow for follow-up questions that probe more deeply into the views expressed by each source. Powerful insights can be gained by asking questions related not only to the respondents’ current views but also to their views of competitors and of the company and its products and services in prior years. Such comparisons provide critical information on how company initiatives are faring and whether other areas of may require attention. Often, it is helpful to use a neutral third party to do this kind of deep digging.

Gathering internal and external facts to map synergies and disconnects in perceptions is a complex and demanding undertaking. But it is an invaluable undertaking as its results reveal exactly how to accelerate revenue growth. Armed with a fact base rooted in input from nine key stakeholder groups, leadership teams and sales organizations can align in understanding critical performance gaps, which creates consensus and buy-in for a change process.

Categories – Commercial Effectiveness