Executives searching for a step-change in growth frequently look at opportunities outside the core of their business. They look at expanding to a new geography, adding new products/services or channels, or pursuing new end-customer markets as a means to increasing revenue. Each of these strategies typically is based on the assumption that the company has optimized performance in its core business and growth must therefore come from outside the core. But we rarely find that to be the case. Instead, by analyzing and making small changes in the operating model, companies can usually unlock significant growth in the core – at far less cost than expansion beyond the core.

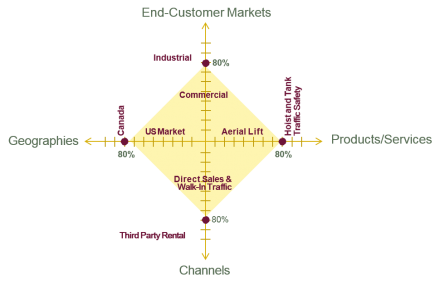

Maximizing core growth is not as easy as it sounds. For starters, we rarely find that executives at a single company share a unified understanding of their core business. Therefore, core growth must begin by bringing together company leaders to reach agreement on a definition of the core. We suggest defining the core as the center of the business that drives 80% of EBITDA along at least four axes: end-customer markets, products/services, channels, and geographies. This is best done on a visual schematic, ideally a spider chart. For each leg of the chart, list out from the center the most to the least significant contributors to EBITDA. Here is an example of what the completed spider chart looked like for a large construction equipment rental company:

When complete, company leaders could see clearly the boundaries of their core business. And they could then answer several critical questions:

- Are we allocating more than 20% of our critical resources to activities outside the core?

- Of the business activities currently outside the core, are any of them likely to be part of the core in three to five years?

- Are the business activities inside the core likely to remain inside the core for three to five years?

- Are there new business activities not currently performed by the company that might become part of the core business in three to five years?

The answers to these questions allowed company leaders to create a future core of the business spider chart based on EBITDA projected three to five years out in the company’s strategic plan. By evaluating the current and future charts side by side, the company identified significant growth opportunities remaining in its core business. It made several adjustments to its growth plan to include pricing changes. It dropped a number of new initiatives that were not focused on core growth and would have drained management time and resources. And it balanced its scarce resources with its most promising growth opportunities. As a result of these changes, the company tripled its value in just two years.

All this may sound like business basics, but going through this exercise has proven to be a powerful experience for many company leaders as it highlights both the value segments and the distractions for a business. In nearly every case, leaders conclude they need to to focus on improvement in market share, customer wallet share or pricing within the core. As long as those opportunities exist, expansion outside the core should be limited to a small number of high-potential initiatives.

Categories – Growth Strategy