Your business has 100% market share and is maximizing spend from every customer, right? If not, there is probably significant opportunity for organic growth within your core business. In most cases, pursuing revenue growth in the core is a more sensible allocation of scarce firm resources than seeking growth through developing new products or entering new geographies. Pursuing such avenues carries inherent monetary risks, distraction of management time and burdens on available resources. Yet many companies jump to seek growth outside their core because they lack the metrics and insights necessary to assess what’s really occurring in their core business revenues.

The root of the problem often lies in the sales and marketing organizations. While most departments, such as finance and operations, have standard sets of metrics they track, no common yardstick exists to evaluate sales and marketing performance. While data exists, often it is not the information that leads to insights for accelerating revenue growth. This absence of facts leaves many queries unanswerable: How productive is the sales organization? Is the sales and marketing team bringing in enough new customers? What is our real customer retention rate? These are the kinds of questions organizations must answer to clearly see their strengths and weaknesses and grow their core revenue.

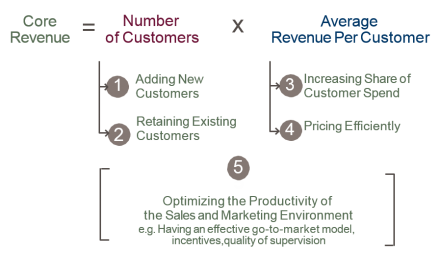

To address this problem we created The Revenue EquationTM. It is a simple framework for breaking down what we call the “revenue engine” – the machine that drives a company’s growth – and understanding why a company is, or is not, growing core revenue. The Revenue Equation looks like this:

On its surface, the equation is very basic: core revenue is derived by multiplying the number of customers by the average revenue per customer. To change the output – revenue – companies must improve one or both of the input variables. That’s the formula at its most basic level; however, its real value comes from digging into each element of the equation. By measuring what is happening within the five categories of sales and marketing performance drivers that impact the equation inputs, companies can understand what is causing core revenue growth or decline and pinpoint their most powerful opportunities for improvement.

It is all about gathering and tracking performance metrics for each of these five categories. For example, in category #1, Adding New Customers, we recommend organizations track the absolute number of new customers added during the quarter, the percent of quarterly revenue coming from new customers, win rate on proposals, the mix of new customer revenue by source/channel, average sales cycle time and more. Metrics related to #2, Retaining Existing Customers, might include the financially-weighted rate of customer attrition, the percent of next quarter’s revenue booked on the first day of the quarter and the number and economic value of lost customers last month/quarter. This data will help the company answer critical questions such as: How quickly are we adding new customers? Are these new customers contributing significantly to our revenue growth? Are we losing customers faster than we are adding them? Armed with these kinds of facts, companies can then zero in on what needs to be improved to increase new customer acquisition and retention, which in turn improves core revenue.

For a complete list of our recommended metrics for each category of sales and marketing performance drivers, click here.

Keep in mind that the metrics we recommend tracking are just a starting point. Each company must select the metrics most relevant for their operation and supplement them with other company-specific data as appropriate. By tracking the right metrics and organizing them into the five categories in the revenue equation, companies can ensure their data is complete and measures all dimensions of revenue engine performance. They then can leverage that information to gain the insights needed to accelerate core business revenues – a quick and cost-effective route to expansion.

Categories – Commercial Effectiveness