The Virus and Brands Conversation

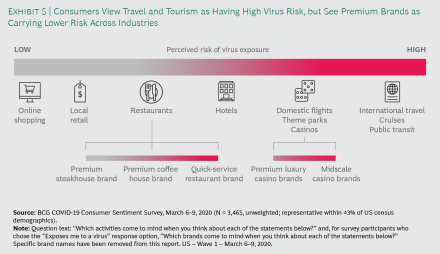

Consumers tend to associate the risk of virus exposure with specific industry sectors or activities rather than with particular brands. For example, they see all cruise brands as carrying a high risk, but all local retail brands as being lower risk. That said, a study found that consumer concerns about virus exposure are lower with luxury and premium brands than with mass brands, across industry sectors, to a statistically significant degree.2 This difference may be due to a perception that these brands maintain a cleaner onsite environment. The data suggests that these brands may rebound a bit more quickly as the market recovers. For example, brand portfolio companies—whose brands range from mass to premium and luxury—that are faced with the challenge of buoying sales when we reach recovery may see more traction from efforts to advance sales of their more premium brands. (See Exhibit 5.)

Category Conversations

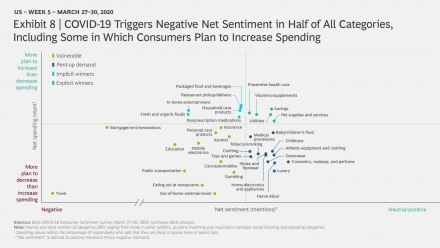

When we look at category spending in developed economies and compare data on online social listening sentiment with data on planned future spending, we see that negative net social sentiment prevails in almost half of all categories—including several categories in which consumers plan to increase their spending (a combination that yields “implicit winners”). (See Exhibit 8.) Relatively few categories—mostly ones related to health and financial responsibilities—have drawn both increased spending and neutral-to-positive chatter (a combination that produces “explicit winners”). For both implicit winners and explicit winners, the current stage of the pandemic crisis is a time for companies to develop plans to capitalize on the incremental spending and engagement they are garnering with consumers in order to retain some of the favorable spending and consumer behavior in the post-COVID-19 that they are winning now. In the case of implicit winners, achieving this goal will call for some extra effort aimed at shifting the conversation to a more neutral or (better yet) positive tone.

Many of the categories marked by neutral or positive conversations but lower planned spending may be building pent-up demand during this period. Consequently, developing plans to engage consumers now and to activate that demand as soon as possible could pay dividends later. The categories with lower planned spending and negative conversations (which are characterized as “vulnerable”) are the ones that will require the most comprehensive and thoughtful plan to endure this potentially protracted period of demand softness and eventually rebuild consumer engagement and trust. Among the categories that qualify as vulnerable are travel, public transportation, and out-of-home entertainment and eating.