Executive initiatives are most impactful when strategic decisions are born from a fact base and performance against objectives can be measured by appropriate metrics. Unfortunately, the sales and marketing functions at most companies lack the metrics and benchmarks that illuminate the performance strengths and weaknesses which ultimately affect revenue. CFOs are armed with data on margins and financial ratios; COOs know their company’s throughput rates, variable labor costs and similar relevant metrics. However, no such standard set of metrics exists for sales and marketing leaders. There may be suspicions and intuition but there are few hard facts to show where improvements in revenue growth can occur.

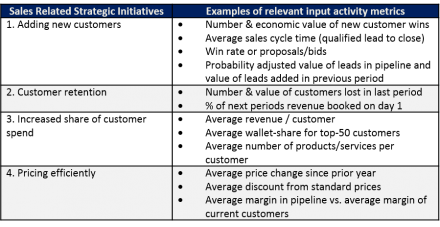

To close this gap, we recommend sales and marketing leaders establish a set of metrics they can track in association with a desired output. Every company already measures total sales output – revenue – but most do not adequately measure the inputs and activities required to produce that output. This is true at a more granular level as well. The chart below shows four common sales-related strategic initiatives. Typically when companies implement these initiatives, they set output goals such as improving customer retention by 25% or adding 10% more new customers in the next quarter. They then launch a series of initiatives aimed at enabling them to reach those targets. However, there is little activity data to support the efforts.

Measuring and tracking internal metrics such as those shown on the chart is necessary to gauge progress against desired objectives, identify weaknesses and define improvements to get back on track. For instance, in a strategic initiative to increase share of customer spend, gathering actual share of spend for your top 50 customers can reveal gaps in sales reps’ estimates and expose previously unseen opportunities. Without a company-wide fact base about this and other metrics related to revenue performance, leadership teams tend to rely on assumptions, anecdotes and old information in explaining revenue performance.

In addition to internal metrics, external benchmarking against competitor or industry standards can highlight where an organization is excelling and where there are opportunities for improvement. Knowing that your share of spend from top customers is flat at 25% over three quarters might sound acceptable – until you learn your top two competitors have been gaining share from the same customers. This fact indicates a problem that needs attention. Are these customers consolidating suppliers? Could you be left out?

External benchmarking not only provides a deeper understanding of your internal metrics, it can help shape the best response to them. A decreasing average revenue per customer, for instance, will likely elicit a different response when considered on its own than if you also knew your competitors were facing the same problem.

Companies often hold strong beliefs about their performance that may be ungrounded and include false assumptions that survive as long as the company or division is profitable. Internal metric capture and external benchmarking against competitors provide critical data for analysis and reality checks and uncover sources of inefficiency that are preventing growth from reaching the next level. Establishing a fact base including internal and external data provides performance answers that assumptions and anecdotes cannot.

Categories – Commercial Effectiveness